January Workshops - Taxation and the Business of Restaurants

CBDC Hants-Kings is hosting four new virtual workshops this month on the topics of Taxation and the Business of Restaurants.

TAX PREPARATION for Sole Proprietors

Presented by: Gary Ross, CPA. Accounting, Tax and Business Advisor

Mon Jan 23rd 6-7:30 pm

Learn how sole proprietors are taxed, tips for preparing sole proprietor returns, and how to manage common expense deductions. This workshop is for sole-proprietor businesses, if you’re incorporated the second session is for you.

Email to register: hants.kings@cbdc.ca

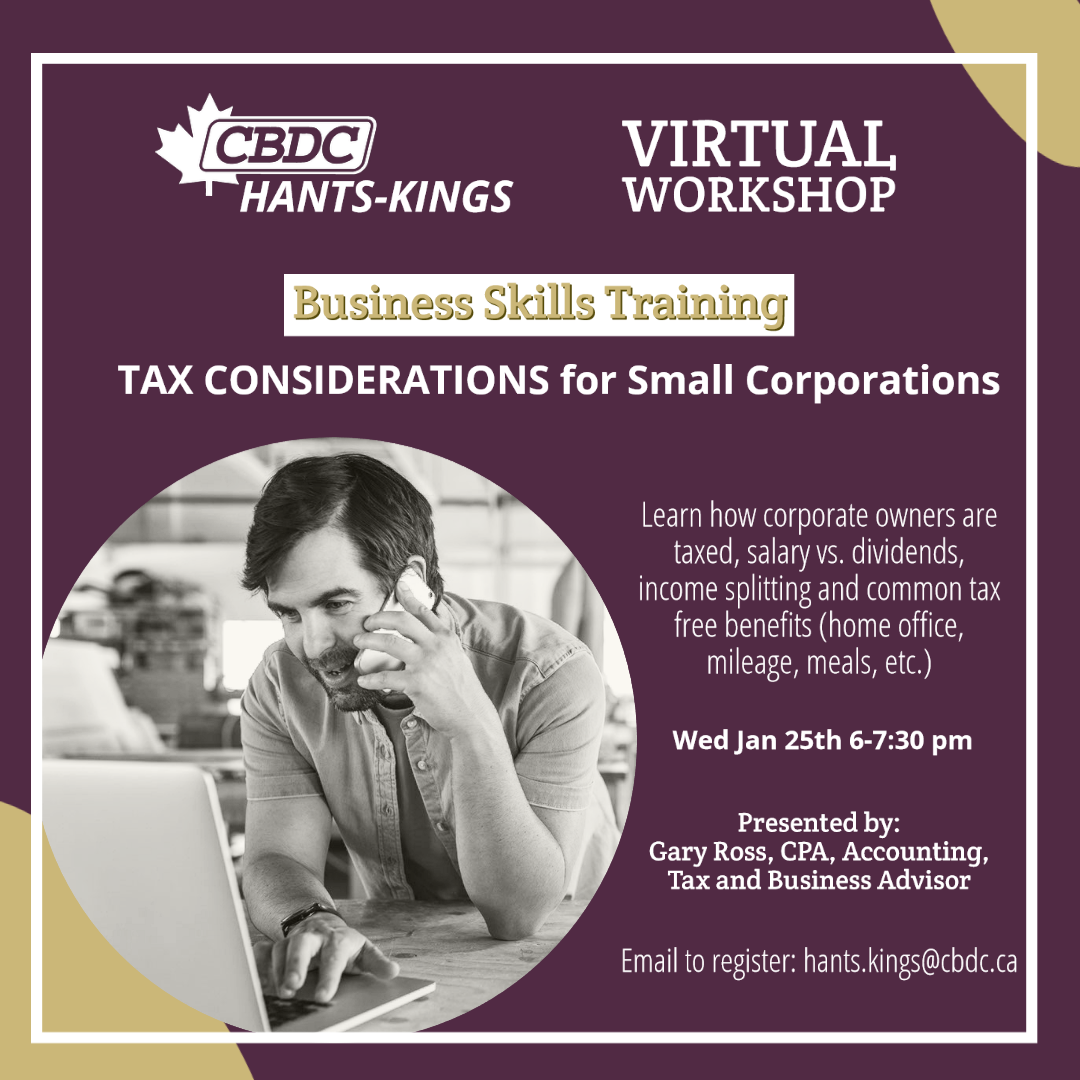

TAX CONSIDERATIONS for Small Corporations

Presented by: Gary Ross, CPA. Accounting, Tax and Business Advisor

Wed Jan 25th 6-7:30 pm

Learn how corporate owners are taxed, salary vs. dividends, income splitting and common tax free benefits (home office, mileage, meals, etc.). This workshop is for incorporated businesses, if you’re a sole proprietor, the first workshop is for you.

Email to register: hants.kings@cbdc.ca

The Business of Restaurants: Session 1: CONTROLLING COSTS

Presented by: Leann Grosvold, Élann Consulting

Learn About:

* Data Tracking & Analysis

* Pricing Considerations

* Inventory Management

* Labour Costs

* Important Investments

Wed Jan 25th 9-11am

Email to register: hants.kings@cbdc.ca

The Business of Restaurants: Session 2 GUEST EXPERIENCE

Presented by: Leann Grosvold, Élann Consulting

Wed Feb 1st 9-11am

Learn About:

* Guest Touch Points & Elevating Your Experience

* Menu Design

* Promotional & Partnership Opportunities

Email to register: hants.kings@cbdc.ca