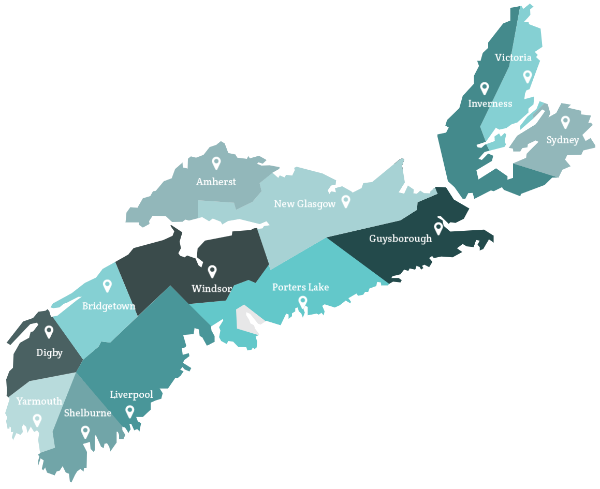

Nova Scotia: Regional Relief and Recovery Fund (RRRF)

Regional Relief and Recovery Fund Expansion

Update on the Regional Relief and Recovery Fund

Demand for the Regional Relief and Recovery Fund has exceeded the funds available and our application portals are now closed.

We know rural small businesses will need ongoing support on the road to recovery. We encourage you to learn more about the variety of small business loans, entrepreneurial training, and business counselling services CBDCs have to offer here or contact your local CBDC directly here.

The RRRF

The Government of Canada and Community Business Development Corporations (CBDCs) understand the difficulties the COVID-19 pandemic has caused the small business community throughout Atlantic Canada. As a result, the Government of Canada has made funds available to the CBDCs to provide support and assistance to Small and Medium-Sized Enterprises (SMEs) located in non-metropolitan regions (all areas served by CBDCs) in Atlantic Canada through the rural stream of the Regional Relief and Recovery Fund (RRRF).

Small business owners impacted as a result of the COVID-19 pandemic can apply for a loan through the Regional Relief and Recovery Funding Expansion.

The Regional Relief and Recovery Fund provides funding to support businesses that have not been approved for supports through the Canada Emergency Business Account (CEBA) or the Emergency Loan Program delivered through Aboriginal Financial Institutions.

General Details of the RRRF Expansion Loan

Loan Limits: Subject to each of the following provisions, the aggregate amount of RRRF Loans to an SME shall normally not exceed $60,000.00. This limit applies to the aggregate of RRRF loans to the SME and any other non-arm’s length enterprise.

- An Initial Loan to a Borrower which had not previously received a RRRF Loan shall not normally exceed $60,000.

- A Supplemental Loan to a Borrower which had received a RRRF loan prior to February 26, 2021 of $40,000.00 may be eligible to receive a Supplemental Loan of up to $20,000.00 such that the aggregate sum of the Initial Loan and the Supplemental Loan shall not normally exceed $60,000.00.

- A Supplemental Loan to an existing Borrower, including Borrowers of an aggregate amount of less than $40,000.00 must not, under any circumstance, exceed $20,000.00 regardless of the amount of the Initial Loan;

- 0% interest until December 31, 2022;

- No principal payments required until December 31, 2022; and

- Principal repayments can be voluntarily made at any time without penalty.

Loan Forgiveness

Where an Applicant receives an Initial Loan and subsequently receives a Supplemental Loan:

- If the Applicant repays at least 75% of the first $40,000 of the aggregate amount of the Loan and at least 50% of the balance of the aggregate amount of the Loan over $40,000 by December 31, 2022, an amount equal to 25% of the first $40,000 plus an amount equal to 50% of the amount between $40,001 and $60,000 will be credited to the outstanding balance of the Loan, for a maximum total credit amount of Twenty Thousand Dollars ($20,000);

- For clarity, an Applicant will not be eligible for any credit unless the Applicant repaid both 75% of the first $40,000 and 50% of the balance over $40,000 by December 31, 2022;

- If any part of the balance is not paid by December 31, 2022, the remaining balance will be converted to a term loan effective January 1, 2023; and

- The full balance must be repaid no later than December 31, 2025.

Eligible Uses for Loan Funding

The funds from this loan shall only be used by the Borrower to pay non-deferrable operating expenses of the Borrower including, without limitation, payroll, rent, utilities, insurance, property tax and regularly scheduled debt service, and may not be used to fund any payments or expenses such as prepayment/refinancing of existing indebtedness, payments of dividends, distributions and increases in management compensation. Note that funds from this loan cannot be used to pay expenses already supported through the Canada Emergency Wage Subsidy or the Canada Emergency Commercial Rent Assistance.

Eligibility of Businesses

- As per Terms and Conditions of the Community Futures Program, SMEs are defined as having less than 500 employees and annual sales revenue of less than $20 million, and produce goods and services for the market economy, regardless of their business structure (e.g. sole proprietorships, social enterprises, cooperatives, etc.);

- SMEs must attest they have not received duplicative supports through other federal or provincial government COVID-19 support programming such as the Canada Emergency Business Account;

- The small business must have been viable and not experiencing any liquidity or other financial difficulties as of March 1, 2020;

- The small business must have experienced a material adverse effect on business operations on or after March 1, 2020 as a result of the COVID-19 pandemic;

- Business established before March 1, 2020; and

- Be a sole proprietorship, partnership, corporation, or social enterprise.

To learn more about the RRRF or to submit an application, click on the links below.

|

Nova Scotia

|

|

Please note: We are currently experiencing a higher than usual number of inquiries and loan applications, which could lead to longer than normal wait times. If you have received an email notification, that is confirmation we have received your application and are working on your request. Rest assured a CBDC representative will contact you soon. Thank you for your cooperation and understanding.